The summer after my first year of graduate school I went back for the last extended time to my parents' home in Washington DC. Joe Pechman, IIRC, got me a desk at the Brookings Institution. And I spent the summer reading as widely as I could and having coffee with Edward Bernstein.

Eric Rauchway:

Keynes’s conference and Morgenthau’s dream: Keynes looks arrogantly at the camera. The qualities of authority, brilliance, and suavity, which Keynes had in personal abundance, were if not lacking then widely distributed among the American delegation: on substantive matters Morgenthau deferred to his assistant Harry Dexter White, who had a better grasp of economics than Morgenthau, and on matters requiring tact White deferred to his assistant Edward Bernstein, who was less likely to say “shit” in public than White. Keynes meanwhile was everywhere, radiating influence from his room at the center of the Mount Washington Hotel, chairing the committee to charter the World Bank but also frequently leading the discussions on the International Monetary Fund; starting informal seminars on economic theory with the delegates he respected and making racist jokes at the expense of those he did not; lining up the best of the hotel wine cellar to host a dinner marking the five hundredth anniversary of an understanding between New College Oxford and King’s College Cambridge. Although suffering from a cardiac ailment that would at length kill him, under the ministrations of his wife and amid the stimulus of the discussions he exhibited extraordinary energy. Keynes disliked going to America, explaining himself, and Jews: yet one night after dinner at the New Hampshire conference he got so excited about the prospect of illustrating a concept to Morgenthau that he charged precipitously up the hotel stairs, giving himself a heart attack that was erroneously reported as fatal in some of the international papers....

ad Keynes fallen prey to his own heart and perished on the hotel stairs, Keynesianism would have survived him and Bretton Woods would have been established as a system anyway.... Bretton Woods would have survived Keynes because Keynes had already won the war of ideas... by 1944 his complaints had become the common foundation for a functional peace, and other ideas he had developed over the subsequent quarter century—about monetary policy, about regulating exchange rates, about the important role an international fund could play in permitting national governments to respond effectively to economic crisis—had adherents throughout the world. But in part Bretton Woods would have survived Keynes because... its underlying assumptions could have been, and indeed were, derived from other intellectual and political traditions.... Morgenthau came from an American tradition—a farm tradition, a free-trading tradition, a Democratic party tradition—to which these ideas about the management of money came readily. And given the need to get an eventual Bretton Woods agreement through the United States Congress, the compatibility of the international system with the Democratic party tradition mattered at least as much as the persuasive powers of a British sybarite—or so Dean Acheson found as he piloted the legislation through the Capitol.

Thus if we want to understand how Bretton Woods happened and why it worked, we need to understand not only the intellectual revolution of Keynesianism and its effects on the policymaking world, but also the American political tradition to which mid-century Democrats were heir, a tradition older than the New Deal...

If you walked into the average bookstore, you'd think that women rule the roost when it comes to personal finance. From Suze Orman's now-classic Women and Money to the more recent (and more colorfully titled) Bitches on a Budget, there's no shortage of do-it-yourself financial advice tailored to women.

Apparently, though, when women make the momentous move from self-help to seeking professional advice about investing and retirement, things go rapidly downhill. A recent study by the Boston Consulting Group revealed that women perceived themselves as receiving wealth management services at a level of quality that is inferior to that received by their male counterparts.

According to the study, women are the key decision-makers when it comes to 27% of the wealth worldwide: that's $20 trillion! But despite the massive chunk of power they wield, 55% of the women surveyed in the study said they felt their wealth manager could do a better job of advising them. Almost a quarter of the respondents said private banks needed "significant improvement" in the services they offer to women.

"The dissatisfaction stems from the unshakable perception that men get more attention, better advice, and sometimes even better terms and deals," according to study co-author Peter Damisch. "We heard this sense of subordination time and time again in our interviews."

This perceived disparity in service arose from several key disconnects in the relationships and communications between women and their financial advisers. Manisha Thakor, Chartered Financial Analyst and women's financial literacy advocate, offers some steps savvy female investors can take to avoid being under-served by their wealth managers and investment advisers:

1. Find your adviser and get your financial education from women-run resources.

The financial services industry is dominated by males and therefore the "DNA is structured around the male experience," Thakor explains, adding that she sees many firms making an effort to change this. Most financial advisers are men, who may not inherently understand the whole-life nature of the average woman's financial plans and needs. They also may have very different communication styles than their women clients.

Thakor recommends women use women-created resources like LearnVest and DailyWorth to educate themselves in order to avoid the intimidation factor when talking about investment products with their advisers. She also encourages women to consult Garrett Planning Network, founded by Certified Financial Planner Sheryl Garrett, to locate a local certified financial planner who works on an hourly-fee-only basis. Taking these steps, Thakor explains, may alleviate the concern expressed by many women in the BCG study that they were not being taken seriously or talked to on the same level as male clients by their financial advisers.

2. Expressly state your ideal career trajectory, then ask how you should alter your investment plans accordingly.

In the BCG study, women stated that their investment advisers fundamentally misunderstood what was actually important to them, and recommended a too-narrow range of inappropriate investment vehicles as a result. Many said their advisers assumed they had a lower risk tolerance than they actually did, or that their advisers focused on short-term results and disregarded their long-term goals, which often included time out to care for a child or parent.

Thakor offers women a script of sorts to remedy this communication disconnect. "Go in and say: "I want to be a mom and I may take X amount of time out of the work force," she advises. Then ask, "How do we adjust how much I need to save and how I should invest to compensate for this?"

3. Start saving early.

robert shumake

Fox <b>News</b> Poll: GOPer Raese Leads By Five Points In WV-SEN | TPMDC

The new Fox News poll of the West Virginia Senate race is giving Republican businessman John Raese a solid lead against Democratic Gov. Joe Manchin, in the race to succeed the late Dem Sen. Robert Byrd.

UT <b>News</b> » Internet Marketing Conference set for Oct. 12

UT News » Internet Marketing Conference set for Oct. 12 Is Paying For Directory Listings a No-No? – Find friends or hook-up tonight | Find Friends or Hook Up Tonight! Says: October 5th, 2010at 10:41 am. UT News » Internet ...

Physics Nobel Goes To Graphene - Science <b>News</b>

Science News. Vol. 166, October 23, 2004, p. 259. [Go to]; D. Castelvecchi. Electron Superhighway: Can graphene overtake silicon as the essential ingredient of computer chips? Science News. Vol.172, September 29, 2007, p. 200. [Go to] ...

robert shumake

Fox <b>News</b> Poll: GOPer Raese Leads By Five Points In WV-SEN | TPMDC

The new Fox News poll of the West Virginia Senate race is giving Republican businessman John Raese a solid lead against Democratic Gov. Joe Manchin, in the race to succeed the late Dem Sen. Robert Byrd.

UT <b>News</b> » Internet Marketing Conference set for Oct. 12

UT News » Internet Marketing Conference set for Oct. 12 Is Paying For Directory Listings a No-No? – Find friends or hook-up tonight | Find Friends or Hook Up Tonight! Says: October 5th, 2010at 10:41 am. UT News » Internet ...

Physics Nobel Goes To Graphene - Science <b>News</b>

Science News. Vol. 166, October 23, 2004, p. 259. [Go to]; D. Castelvecchi. Electron Superhighway: Can graphene overtake silicon as the essential ingredient of computer chips? Science News. Vol.172, September 29, 2007, p. 200. [Go to] ...

robert shumake

The summer after my first year of graduate school I went back for the last extended time to my parents' home in Washington DC. Joe Pechman, IIRC, got me a desk at the Brookings Institution. And I spent the summer reading as widely as I could and having coffee with Edward Bernstein.

Eric Rauchway:

Keynes’s conference and Morgenthau’s dream: Keynes looks arrogantly at the camera. The qualities of authority, brilliance, and suavity, which Keynes had in personal abundance, were if not lacking then widely distributed among the American delegation: on substantive matters Morgenthau deferred to his assistant Harry Dexter White, who had a better grasp of economics than Morgenthau, and on matters requiring tact White deferred to his assistant Edward Bernstein, who was less likely to say “shit” in public than White. Keynes meanwhile was everywhere, radiating influence from his room at the center of the Mount Washington Hotel, chairing the committee to charter the World Bank but also frequently leading the discussions on the International Monetary Fund; starting informal seminars on economic theory with the delegates he respected and making racist jokes at the expense of those he did not; lining up the best of the hotel wine cellar to host a dinner marking the five hundredth anniversary of an understanding between New College Oxford and King’s College Cambridge. Although suffering from a cardiac ailment that would at length kill him, under the ministrations of his wife and amid the stimulus of the discussions he exhibited extraordinary energy. Keynes disliked going to America, explaining himself, and Jews: yet one night after dinner at the New Hampshire conference he got so excited about the prospect of illustrating a concept to Morgenthau that he charged precipitously up the hotel stairs, giving himself a heart attack that was erroneously reported as fatal in some of the international papers....

ad Keynes fallen prey to his own heart and perished on the hotel stairs, Keynesianism would have survived him and Bretton Woods would have been established as a system anyway.... Bretton Woods would have survived Keynes because Keynes had already won the war of ideas... by 1944 his complaints had become the common foundation for a functional peace, and other ideas he had developed over the subsequent quarter century—about monetary policy, about regulating exchange rates, about the important role an international fund could play in permitting national governments to respond effectively to economic crisis—had adherents throughout the world. But in part Bretton Woods would have survived Keynes because... its underlying assumptions could have been, and indeed were, derived from other intellectual and political traditions.... Morgenthau came from an American tradition—a farm tradition, a free-trading tradition, a Democratic party tradition—to which these ideas about the management of money came readily. And given the need to get an eventual Bretton Woods agreement through the United States Congress, the compatibility of the international system with the Democratic party tradition mattered at least as much as the persuasive powers of a British sybarite—or so Dean Acheson found as he piloted the legislation through the Capitol.

Thus if we want to understand how Bretton Woods happened and why it worked, we need to understand not only the intellectual revolution of Keynesianism and its effects on the policymaking world, but also the American political tradition to which mid-century Democrats were heir, a tradition older than the New Deal...

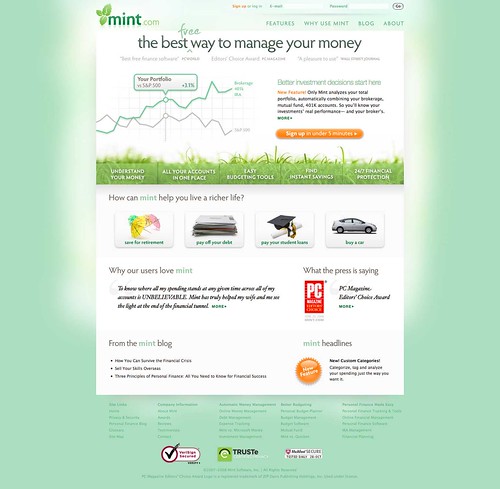

If you walked into the average bookstore, you'd think that women rule the roost when it comes to personal finance. From Suze Orman's now-classic Women and Money to the more recent (and more colorfully titled) Bitches on a Budget, there's no shortage of do-it-yourself financial advice tailored to women.

Apparently, though, when women make the momentous move from self-help to seeking professional advice about investing and retirement, things go rapidly downhill. A recent study by the Boston Consulting Group revealed that women perceived themselves as receiving wealth management services at a level of quality that is inferior to that received by their male counterparts.

According to the study, women are the key decision-makers when it comes to 27% of the wealth worldwide: that's $20 trillion! But despite the massive chunk of power they wield, 55% of the women surveyed in the study said they felt their wealth manager could do a better job of advising them. Almost a quarter of the respondents said private banks needed "significant improvement" in the services they offer to women.

"The dissatisfaction stems from the unshakable perception that men get more attention, better advice, and sometimes even better terms and deals," according to study co-author Peter Damisch. "We heard this sense of subordination time and time again in our interviews."

This perceived disparity in service arose from several key disconnects in the relationships and communications between women and their financial advisers. Manisha Thakor, Chartered Financial Analyst and women's financial literacy advocate, offers some steps savvy female investors can take to avoid being under-served by their wealth managers and investment advisers:

1. Find your adviser and get your financial education from women-run resources.

The financial services industry is dominated by males and therefore the "DNA is structured around the male experience," Thakor explains, adding that she sees many firms making an effort to change this. Most financial advisers are men, who may not inherently understand the whole-life nature of the average woman's financial plans and needs. They also may have very different communication styles than their women clients.

Thakor recommends women use women-created resources like LearnVest and DailyWorth to educate themselves in order to avoid the intimidation factor when talking about investment products with their advisers. She also encourages women to consult Garrett Planning Network, founded by Certified Financial Planner Sheryl Garrett, to locate a local certified financial planner who works on an hourly-fee-only basis. Taking these steps, Thakor explains, may alleviate the concern expressed by many women in the BCG study that they were not being taken seriously or talked to on the same level as male clients by their financial advisers.

2. Expressly state your ideal career trajectory, then ask how you should alter your investment plans accordingly.

In the BCG study, women stated that their investment advisers fundamentally misunderstood what was actually important to them, and recommended a too-narrow range of inappropriate investment vehicles as a result. Many said their advisers assumed they had a lower risk tolerance than they actually did, or that their advisers focused on short-term results and disregarded their long-term goals, which often included time out to care for a child or parent.

Thakor offers women a script of sorts to remedy this communication disconnect. "Go in and say: "I want to be a mom and I may take X amount of time out of the work force," she advises. Then ask, "How do we adjust how much I need to save and how I should invest to compensate for this?"

3. Start saving early.

No comments:

Post a Comment